US Housing Market 2025: Trends, Home Prices & Interest Rate Forecast

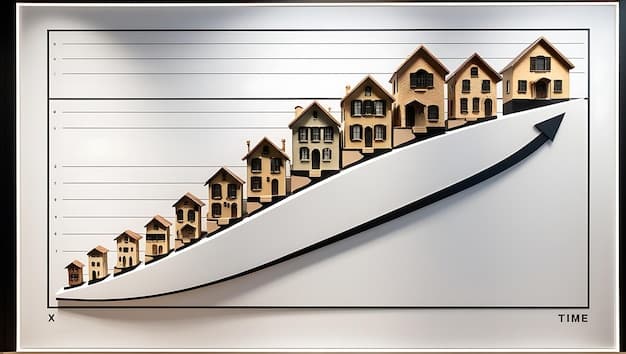

The US housing market in 2025 is expected to see a mix of trends, including fluctuating home prices influenced by inventory levels and interest rates, with experts suggesting a potential stabilization or slight increase in prices depending on economic conditions.

Navigating the complexities of the US Housing Market: What are the Trends and Predictions for Home Prices and Interest Rates in 2025? requires a keen understanding of current economic indicators and expert forecasts. Let’s delve into the key factors that will shape the housing landscape in the coming year.

Understanding the Current US Housing Market Landscape

To accurately predict the trends and forecasts for the US housing market in 2025, it’s crucial to first understand the current state of the market. Several factors are currently influencing the housing sector, including economic conditions, interest rates, and housing inventory.

Key Economic Indicators

Economic indicators such as GDP growth, employment rates, and inflation play a significant role in shaping the housing market. Strong economic growth typically leads to higher demand for housing, while high inflation and interest rates can dampen demand.

Impact of Interest Rates

Interest rates, particularly mortgage rates, have a direct impact on the affordability of homes. Higher interest rates increase the cost of borrowing, making it more expensive for potential buyers to purchase a home, thus reducing demand.

- Current Mortgage Rates: Analyze the current average mortgage rates and their historical trends.

- Federal Reserve Policies: Review the Federal Reserve’s monetary policies and their potential impact on interest rates.

- Housing Affordability: Assess how interest rates affect overall housing affordability for different income levels.

The US housing market’s current landscape is influenced by a delicate balance of economic indicators and interest rate dynamics. Understanding these factors is essential for predicting future trends and making informed decisions.

Predictions for Home Prices in 2025

Predicting home prices in 2025 involves analyzing various factors that influence the housing market, such as supply and demand, economic growth, and affordability. Expert opinions and statistical models provide insights into potential scenarios.

Supply and Demand Dynamics

The balance between housing supply and demand is a critical determinant of home prices. A shortage of homes typically leads to increased prices, while an oversupply can cause prices to decline.

Expert Forecasts

Several real estate experts and economists have offered their forecasts for home prices in 2025, considering various market conditions and economic factors. These forecasts vary, reflecting the inherent uncertainties in the housing market.

- National Association of Realtors (NAR): Review NAR’s projections for home sales and price appreciation.

- Zillow Economic Forecast: Analyze Zillow’s forecasts for regional and national home prices.

- Redfin Housing Market Outlook: Examine Redfin’s predictions for inventory levels and price changes.

Predictions for home prices in 2025 vary based on different models and assumptions. Monitoring these forecasts and understanding the underlying factors will help stakeholders make more informed decisions in the housing market.

Interest Rate Trends and Their Impact

Interest rates play a pivotal role in shaping the housing market. Understanding the projected trends and their potential impacts is crucial for both buyers and sellers.

Factors Influencing Interest Rates

Several factors influence interest rates, including inflation, economic growth, and monetary policies set by the Federal Reserve. Analyzing these factors helps in understanding the potential direction of interest rates.

Potential Scenarios for 2025

Based on current economic conditions and expert forecasts, there are several potential scenarios for interest rates in 2025. These scenarios range from stable rates to moderate increases or decreases.

- Stable Rate Environment: Explore the implications of stable interest rates on housing affordability and demand.

- Moderate Increase: Analyze how a moderate increase in interest rates could affect home sales and prices.

- Rate Decrease: Evaluate the potential benefits of decreasing interest rates on the housing market.

Interest rate trends significantly impact the housing market. Keeping abreast of these trends and understanding their potential consequences is essential for navigating the market effectively.

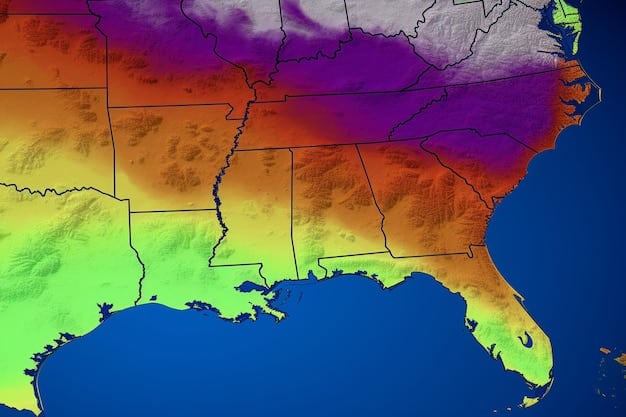

Regional Variations in the Housing Market

The US housing market is not monolithic; regional variations exist due to local economic conditions, population growth, and housing supply. Understanding these regional differences is critical for targeted analysis.

High-Growth Areas

Certain regions in the US are experiencing rapid population and economic growth, leading to increased demand for housing and higher home prices. These areas typically offer attractive job opportunities and quality of life.

Slowing Markets

Some regions are facing economic challenges or declining populations, resulting in slower housing markets with stagnant or declining home prices. These areas may offer more affordable housing options but fewer job prospects.

- Sun Belt States: Discuss the growth and opportunities in states like Florida, Texas, and Arizona.

- Northeast Corridor: Analyze the trends and challenges in states like New York, Massachusetts, and Pennsylvania.

- Midwest Markets: Examine the housing conditions in states like Illinois, Ohio, and Michigan.

Regional variations significantly influence the US housing market. Understanding these differences is essential for making informed decisions tailored to specific local conditions.

Impact of Demographic Trends on Housing

Demographic trends, such as population growth, aging population, and household formation, significantly influence the demand for housing. These trends shape the types of homes that are in demand and where they are needed.

Millennial and Gen Z Influence

Millennials and Gen Z are becoming significant players in the housing market, influencing the demand for different types of homes and locations. Their preferences for urban living, smaller spaces, and sustainable homes are shaping market trends.

Aging Population

The aging population is also impacting the housing market, with increased demand for senior living communities, accessible homes, and retirement destinations. Understanding these needs is crucial for developers and policymakers.

- First-Time Homebuyers: Analyze the challenges and opportunities for millennials and Gen Z entering the housing market.

- Retirement Communities: Discuss the growth and demand for housing options catering to seniors.

- Urban vs. Suburban Living: Examine the shifting preferences for urban and suburban lifestyles among different age groups.

Demographic trends play a crucial role in shaping the housing market. Understanding these trends helps in anticipating future demand and tailoring housing solutions accordingly.

Strategies for Buyers and Sellers in 2025

Navigating the housing market in 2025 requires strategic planning for both buyers and sellers. Understanding the market conditions and adapting to the changing landscape can lead to more favorable outcomes.

For Buyers

Buyers need to carefully evaluate their financial situation, understand the local market conditions, and be prepared to act quickly when they find the right property. Strategies may include pre-approval for a mortgage, working with a knowledgeable real estate agent, and being flexible with their preferences.

For Sellers

Sellers should focus on preparing their homes for sale, pricing them competitively, and marketing them effectively to attract potential buyers. Strategies may include making necessary repairs and upgrades, staging the home, and using online marketing tools.

- Mortgage Pre-Approval: Emphasize the importance of getting pre-approved for a mortgage before starting the home search.

- Negotiation Strategies: Provide tips for negotiating effectively in a competitive market.

- Home Staging: Discuss the benefits of staging a home to increase its appeal to buyers.

Strategic planning is essential for both buyers and sellers navigating the housing market in 2025. Adapting to changing market conditions and understanding local dynamics can improve outcomes for all stakeholders.

| Key Point | Brief Description |

|---|---|

| 📈 Home Prices | Expected to stabilize or slightly increase based on inventory. |

| 💰 Interest Rates | Influenced by inflation and Federal Reserve policies. |

| 🏘️ Regional Variations | Differ significantly across states due to local economies. |

| 🧑🤝🧑 Demographic Trends | Millennials and aging population shape housing demand. |

Frequently Asked Questions (FAQs)

▼

Home prices are influenced by various factors, including supply and demand, economic growth, interest rates, and demographic trends. A shortage of homes can drive prices up, while higher interest rates can decrease affordability.

▼

Interest rates, particularly mortgage rates, have a direct impact on housing affordability. Higher interest rates increase the cost of borrowing, making it more expensive for potential buyers to purchase a home.

▼

The US housing market varies significantly by region due to local economic conditions, population growth, and housing supply. Some regions experience rapid growth, while others face economic challenges.

▼

Key players include real estate experts, economists, the National Association of Realtors (NAR), Zillow, and Redfin. These entities provide forecasts and analyses that help shape market expectations.

▼

Buyers should evaluate their financial situation and understand local market conditions. Sellers should prepare their homes for sale and price them competitively. Strategic planning is essential for both.

Conclusion

As we look to 2025, the US housing market presents a complex interplay of economic factors, demographic shifts, and regional variations. Staying informed and adaptable will be key for both buyers and sellers to navigate this dynamic landscape successfully. By understanding the trends and forecasts, stakeholders can make well-informed decisions and achieve their housing goals.