Fed Rate Hike in 2025: Impact on US Mortgage Rates

The Projected Impact of the Federal Reserve’s Anticipated 0.75% Interest Rate Hike in Early 2025 on Mortgage Rates is expected to lead to increased borrowing costs for homebuyers, potentially cooling the housing market and affecting affordability, but the precise impact will depend on broader economic conditions and investor sentiment.

Anticipating the movements of the Federal Reserve is crucial for anyone involved in the real estate market. Let’s delve into what is the projected impact of the Federal Reserve’s anticipated 0.75% interest rate hike in early 2025 on mortgage rates, and how this economic shift could affect your financial decisions.

Understanding the Federal Reserve’s Role

The Federal Reserve, often simply called the Fed, plays a pivotal role in managing the U.S. economy. One of its primary tools is setting the federal funds rate, influencing interest rates throughout the economy. Understanding this mechanism is essential before evaluating the potential impact of a rate hike.

What is the Federal Funds Rate?

The federal funds rate is the target rate that the Federal Reserve wants banks to charge one another for the overnight lending of reserves. It serves as a benchmark for other interest rates, including those for mortgages. When the Fed raises this rate, it becomes more expensive for banks to borrow money.

How Does the Fed Control Interest Rates?

The Fed uses various tools to influence the federal funds rate, most notably open market operations, where it buys or sells government securities. Buying securities injects money into the banking system, lowering rates, while selling securities does the opposite, raising rates. This influences the entire spectrum of interest rates.

- The Fed aims to maintain price stability by controlling inflation.

- Lowering rates can stimulate economic growth during downturns.

- Raising rates can cool down an overheating economy.

In essence, the Federal Reserve acts as a central bank, using its monetary policy tools to keep the economy on a steady path. Its decisions directly impact the interest rates consumers and businesses face, including those for mortgages.

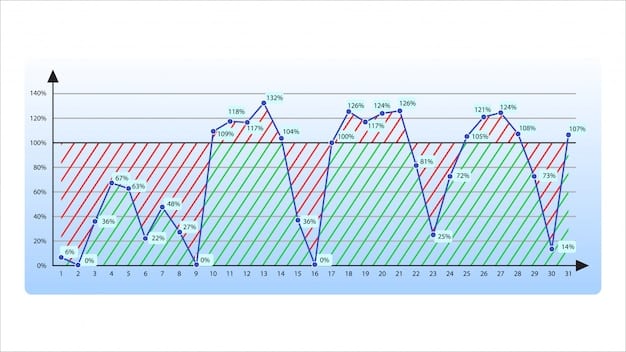

Historical Context: Rate Hikes and Mortgage Rates

Examining past instances of Federal Reserve rate hikes provides valuable insights into how mortgage rates typically react. Historical data often reveals patterns, although it’s crucial to remember that economic conditions vary each time, making precise predictions difficult.

Past Rate Hike Cycles

Looking back at previous periods when the Fed raised interest rates, we often see a corresponding increase – but not always a perfect match – in mortgage rates. For instance, during periods of rapid economic expansion, the Fed might aggressively raise rates, leading to a more noticeable jump in mortgage costs.

The 2004-2006 Rate Hikes

A notable example is the series of rate hikes between 2004 and 2006. The Fed steadily increased the federal funds rate, and mortgage rates followed suit, eventually contributing to a cooling housing market. However, other factors like lending standards also played a significant role.

- Mortgage rates don’t always move in lockstep with the federal funds rate.

- Investor expectations and bond market reactions also influence mortgage rates.

- Global economic conditions can further complicate the relationship.

Understanding historical reactions helps to temper expectations, but it also underscores the complexity of predicting future impacts. While rate hikes generally push mortgage rates higher, the actual magnitude can vary.

Projecting the Impact of a 0.75% Rate Hike

A projected 0.75% interest rate hike by the Federal Reserve in early 2025 could have a significant impact on mortgage rates. While it’s impossible to predict the exact outcome, we can look at potential scenarios and contributing factors.

Likely Scenarios for Mortgage Rates

In a typical scenario, a 0.75% hike in the federal funds rate could translate to roughly a similar increase in mortgage rates, although this isn’t guaranteed. Factors such as investor confidence and the overall health of the economy play a role in determining how much mortgage rates will change.

Factors Influencing the Mortgage Rate Response

If the economy is strong and inflation is a concern, mortgage rates might rise even more than 0.75% as investors anticipate further rate hikes. Conversely, if economic growth is slowing or there’s uncertainty in the market, mortgage rates might increase by less than 0.75% of rate hike.

- The strength of the economy at the time of the rate hike.

- Investor expectations regarding future monetary policy.

- Global economic conditions and geopolitical events.

The response of mortgage rates to a Fed rate hike is not always straightforward, but understanding the various influencing factors can help anticipate the potential effects.

Impact on Homebuyers and the Housing Market

An increase in mortgage rates directly affects homebuyers, influencing affordability and demand. Higher rates typically lead to increased borrowing costs, potentially cooling the housing market and shifting its dynamics.

Reduced Affordability

Higher mortgage rates mean higher monthly payments for homebuyers. This can make it more difficult for people to afford a home, particularly first-time buyers who are already facing challenges like saving for a down payment and securing financing. Increased costs can push some potential buyers out of the market.

Cooling Housing Demand

As affordability decreases due to higher mortgage rates, demand for homes could decline. This can lead to a slowdown in home sales and potentially moderate home price growth. A more balanced market may emerge, giving buyers more negotiating power.

- Higher rates increase monthly mortgage payments.

- Demand for homes may decrease due to reduced affordability.

- Home price growth might slow down or even decline in some markets.

For homebuyers, the impact of a rate hike often translates to increased borrowing costs and potentially less competition in the housing market. However, it’s crucial to fully assess individual financial situations and local market conditions.

Strategies for Navigating Rising Mortgage Rates

Facing the prospect of rising mortgage rates requires strategic planning. Homebuyers and homeowners alike can take certain steps to mitigate the impact and better manage their finances.

For Homebuyers

Potential homebuyers should consider several strategies. Shopping around for the best mortgage rates from multiple lenders remains crucial. Improving your credit score can also help secure a lower rate. Consider delaying the purchase if you anticipate rates rising further.

For Current Homeowners

Current homeowners with adjustable-rate mortgages (ARMs) might consider refinancing to a fixed-rate loan to protect against future rate increases. Making extra payments on your mortgage can also help reduce the total interest paid over the life of the loan.

- Shop around for the best mortgage rates.

- Consider a shorter-term mortgage to pay off a home quicker.

- Refinance adjustable-rate mortgages to fixed-rate mortgages.

Being proactive and informed is vital when navigating a rising interest rate environment. Whether you’re buying a home or already own one, taking smart financial steps can ease the burden and optimize your financial position.

The Broader Economic Outlook

The Federal Reserve’s decision to raise interest rates is influenced by the broader economic outlook. Monitoring key economic indicators provides a context for understanding the Fed’s actions and anticipating future moves.

Key Economic Indicators

Inflation, GDP growth, and employment figures are crucial indicators the Fed considers. High inflation often prompts the Fed to raise rates, while slowing economic growth might lead to pauses or even rate cuts. Monitoring these indicators can help anticipate changes in monetary policy.

Expert Opinions and Forecasts

Following the insights of economists and financial analysts can also offer valuable perspectives. Many experts provide forecasts about future Fed actions and their potential impact on interest rates and the economy.

- Keep an eye on inflation rates and GDP growth.

- Follow expert analysis and economic forecasts.

- Consider global economic trends and geopolitical events.

By monitoring economic indicators and expert opinions, you can gain a better understanding of the forces shaping the Federal Reserve’s decisions and how they might affect mortgage rates.

| Key Aspect | Brief Description |

|---|---|

| 📊 Federal Funds Rate | The Fed’s target rate influences other interest rates, including mortgages. |

| 🏡 Mortgage Rate Impact | A 0.75% Fed rate hike could increase mortgage rates, affecting affordability. |

| 💰 Homebuyer Strategies | Shop rates, improve credit, and consider fixed-rate mortgages. |

| 🌍 Economic Factors | Inflation, GDP, and global events influence the Fed’s decisions. |

Frequently Asked Questions (FAQs)

▼

The Federal Reserve influences mortgage rates primarily by setting the federal funds rate. This rate affects the cost for banks to borrow money, which in turn influences the interest rates they charge to consumers for loans, including mortgages.

▼

A 0.75% rate hike generally increases the cost of borrowing, making homes less affordable for homebuyers. This can lead to higher monthly payments, potentially deterring some individuals from entering the housing market.

▼

Yes, homeowners can refinance adjustable-rate mortgages to fixed-rate loans to secure a stable interest rate. Additionally, making extra mortgage payments can reduce the principal and overall interest paid over time

▼

Economic indicators such as inflation, GDP growth, and employment rates play a significant role. High inflation often prompts the Fed to raise rates to cool down the economy, while weak economic growth may deter them from doing so.

▼

Homebuyers can shop around for the best mortgage rates, improve credit scores to qualify for lower rates, and consider delaying the purchase if they anticipate further rate increases. Consulting with a financial advisor is also beneficial.

Conclusion

In summary, the anticipated 0.75% interest rate hike by the Federal Reserve in early 2025 is likely to increase mortgage rates, potentially impacting affordability and demand in the housing market. Being informed, staying proactive, and understanding the broader economic environment are key to navigating these financial shifts effectively.